Analysis to support energy efficiency financing.

Energy Efficiency in Real Estate Financing

Commercial real estate financing currently does not fully account for energy factors in underwriting, valuation and asset management, particularly as it relates to the impact of energy costs on net operating income. As a consequence, energy efficiency is not properly valued and energy risks are not properly assessed and mitigated. However, real estate financing is a large lever and could be a significant channel for scaling energy efficiency investments. LBNL is working to lay the foundation for developing scalable interventions to address this issue in partnership with mortgage lenders, building owners and other stakeholders.

Commercial real estate financing currently does not fully account for energy factors in underwriting, valuation and asset management, particularly as it relates to the impact of energy costs on net operating income. As a consequence, energy efficiency is not properly valued and energy risks are not properly assessed and mitigated. However, real estate financing is a large lever and could be a significant channel for scaling energy efficiency investments. LBNL is working to lay the foundation for developing scalable interventions to address this issue in partnership with mortgage lenders, building owners and other stakeholders.

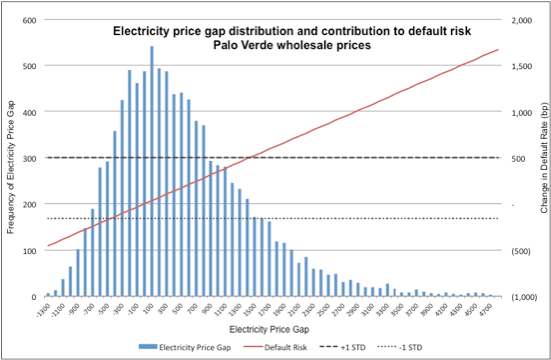

- Analysis of the impacts of energy costs on default rates in commercial mortgages.

- Development of an energy risk score for lenders to use in mortgage underwriting.

- Collection and analysis of lease-level data to analyze the impacts of green features on building value and leasing metrics.

For more information visit cbs.lbl.gov

Alternative Financing Mechanisms

The process of financing energy efficiency retrofits or alternative energy installations is quite complex. Many technical details need to be addressed to achieve a successful project. We conduct research and provide technical support in the following areas of public-sector procurement:

The process of financing energy efficiency retrofits or alternative energy installations is quite complex. Many technical details need to be addressed to achieve a successful project. We conduct research and provide technical support in the following areas of public-sector procurement:

- Legal expertise in federal acquisition regulations regarding alternative finance mechanisms

- Technical expertise in technology specification and implementation

- Economic expertise in utility tariffs, energy price trends, and other project cost drivers

- Evaluation expertise in determination of realized energy savings

For more information go to: sfog.lbl.gov